Many markets are already beginning to experience a relaxation of restrictive confinement measures. The truth is that the current scenario in the various markets is very different from what we saw at the beginning of the year.

Over these months, users have had to cover needs such as entertainment and regular food shopping from their homes, in many cases. The industry of Fast Moving Consumer Goods has experienced how this change in purchasing habits can become a positive factor to be taken into account in their business models. For this same reason, it is essential to continue to analyse and detect improvements in the different product categories and how these are shown to the end consumer.

As far as the online food sector is concerned, Netrivals has carried out a price study in five online supermarkets: Consum, Condis, Ulabox, Mercadona and Carrefour.

The study has taken into account the same measurement dates on all products. More specifically, the measurement dates correspond to the time period between February and May, respectively.

Similarly, it should be noted that the study has taken into account a different quantity and distribution of products and categories in each of the supermarkets. In this way, we can establish that the analysis has not been based on a comparison of identical products existing between the different supermarkets, but has been developed taking into account the individual context of each of the stores.

We will now detail, for each of the supermarkets, the most relevant results that have been extracted in the study of the set of products and categories in each case. In the case of the data provided at the level of changes and differences in price, these will always be provided as averages both at the level of price in euros, and as percentages.

Consum

In the case of Consum, a total of 619 products have been analysed. For the products analysed in this supermarket, there was an initial average price of EUR 2,504 and a final average price of EUR 2,518. In the total of the 619 products analysed, the following has been detected:

- 385 (62.2%) of the products studied have not changed in price.

- 132 (21.32%) of the products analysed have experienced price increases. During the period of the study the average price increase in this subset of products was 16.32% (+0.31 EUR).

- 102 (16.48%) of the products analysed have experienced a decrease in price. During the period of the study the average decrease of prices in this subset of products has been -12.94% (-0.32 EUR).

Analysis of categories with outstanding changes

We will now provide details of changes in some of the categories of Consum.

Price reduction

Drinks

With the exception of Cokes, which have kept their price stable throughout the analysis, the beverage category has been one of the leading categories in price reduction. More specifically, 21 products in the overall drinks mix (minus queues) experienced an average price decrease of -15.68% (‘0.20).

Fresh products

The fresh products category has also experienced a decrease in price. In this case, 10 products have experienced an average price reduction of -7.62% (-0.21 EUR).

Pantry

For the products in the pantry category, the average reduction in prices for the 13 products analysed was -15.27% (-0.34 EUR).

Price increase

In terms of the price increase, the citrus category has risen the most. Specifically, 6 articles within this category have increased in price by an average of 30.47% (0.45 EUR).

Stable prices

Among the most invariable categories, Cola stand out: 18 of the 22 articles analysed in this category (82%) remain unchanged. This invariability extends to the categories of: jams (8/8), special milks (6/6), chewing gum, candies and jelly beans (5/5).

Condis

In the case of Condis, a total of 1557 products have been analysed. For the products analysed in this supermarket, there was an average initial price of EUR 3,345 and a final average price of EUR 3,393. For the total of 1557 products analysed, the following has been found:

- 1044 (67.05%) of the products analysed have remained unchanged at price level.

- 347 of the products in the study (22.29%) have experienced a price increase. During the study period the average price increase for this subset of products was 14.44% (+0.40 EUR).

- 166 (10.66%) of the products analysed have experienced a decrease in price. During the period of the study the average price decrease in this subset of products was -11.95% (-0.39 EUR).

Category analysis with outstanding changes

Below we will provide details of changes in some of Condis’ own categories.

Reducción de precios

Ice Cream

Out of the 10.7% of the total products that have lowered the price, it is the ice cream category that stands out in this respect: 14 of the 27 articles analysed in this category have lowered the price.

Price increase

Regarding price increases, in the Laundry category, 38% of the products analysed (15/39) have experienced an average price increase of 9%. In the case of Hair products (mainly dyes), 46% of the products analysed (13/28) have seen an average price increase of 4.22%. In the category of Marmalades and Jams, 60% of the products in the study (12/20) saw an average increase of 5.85%.

Stable prices

Among the most stable categories with respect to price, the following stand out: Soft drinks, with a total of 59 products with stable prices; Cheeses, with 32 products with invariable prices; Cookies, with 34 products with stable prices; and Beers with 30 products with stable prices.

Ulabox

This is the supermarket where price variations are most homogeneous among all categories. This means that there are no categories with generalised price increases, nor categories with generalised price decreases. As an indication, the average initial price of the products in this supermarket was EUR 3,665, while the average final price was EUR 3,688.

In the case of this supermarket, 2506 products have been included in the study. Of these products, we can highlight the following:

- 1303 of the products analysed (52%) have kept their prices stable.

- 674 products (26.9%) in the study have increased their price. The average price increase for these products was +12.47% (‘0.32).

- In terms of price reduction, 529 (21.11%) products have suffered an average price reduction of -9% (‘0.30).

Category analysis

Below we will provide details about changes in some of the Ulabox categories.

Price reduction

Regarding price reductions, the soluble coffee category has reduced its prices by 6.73%, and the chocolate and snacks category has experienced a 6.74% reduction.

Price increase

In the case of products that have experienced an increase in price, we can highlight the category of Candy and Jelly Beans that have increased by 7.68% in the products analyzed, respectively.

Mercadona

In Mercadona’s case, a total of 444 products have been analysed. In this supermarket, the average initial price of the products studied was EUR 3,479 and the average final price was EUR 3,481.

Of the 444 products considered for this supermarket, we can point out the following:

- 337 (75.90%) products of the total items analyzed have remained stable in price.

- 52 (11.71%) products of the total analyzed have reduced their price. The average reduction in this case was -15.75% (-0.41 EUR).

- 55 products (12.39%) of the total analysed have increased their price. This increase was 14.05% (0.40 EUR).

Below we will provide more information on specific Mercadona categories.

The most variable

The category with the most changes in price has been Fruit and Vegetables: 25 of the products in this category have decreased in price, while 17 of them have increased, and another 26 items have remained stable in price.

Price increase

Mercadona Cokes category has risen in price by an average of 4%, with 8 of the 20 products analysed rising in price. In the case of the category of Desserts and Yoghurts, the average increase was 3%, in 5 of the 12 products included.

Price Stability

The group of products analysed at Mercadona stands out for its lower level of variability, as 76% of the total articles analysed maintain their prices. In this sense, the categories of Meat, Charcuterie and Cheese, as well as the Baby category stand out for not having modified their prices.

Carrefour

Like in the case of Ulabox, the price increases and decreases have been homogeneous among all categories. In the case of Carrefour, a total of 8221 products have been analysed. It should be noted that the average price has been maintained over time, which compensates for the 6.78% increase in products that have increased in price and the 6.54% reduction in products that have decreased in price. This can be confirmed, as both the average initial price and the average final price are the same: EUR 4.398.

Of the 8221 products analysed in this supermarket, we can point out the following

- 5131 (62.41%) of the total products have remained unchanged in terms of price.

- 1273 products (15.48%) of the total studied have experienced a price reduction. The average price reduction for this set of products was -6.54% (-0.34 EUR).

- 1817 products (22.1%) of the total analysed have suffered a price increase. The average price increase for these products was +6.78% (+0.24 EUR).

Price reduction

In the context of the price reductions, the following categories should be highlighted:Berries are down by 13.6%, and the fresh fish category is down by 8.36%.

Price increase

In the case of the products analysed for this supermarket, no category stands out due to significant price increases. The most notable categories are Skimmed Yoghurt with a +7.02% increase and Cokes with a +4.82% increase.

Price stability

In the case of the products analysed in Carrefour, the Vegetable category has maintained a stable price for 78% of the products.

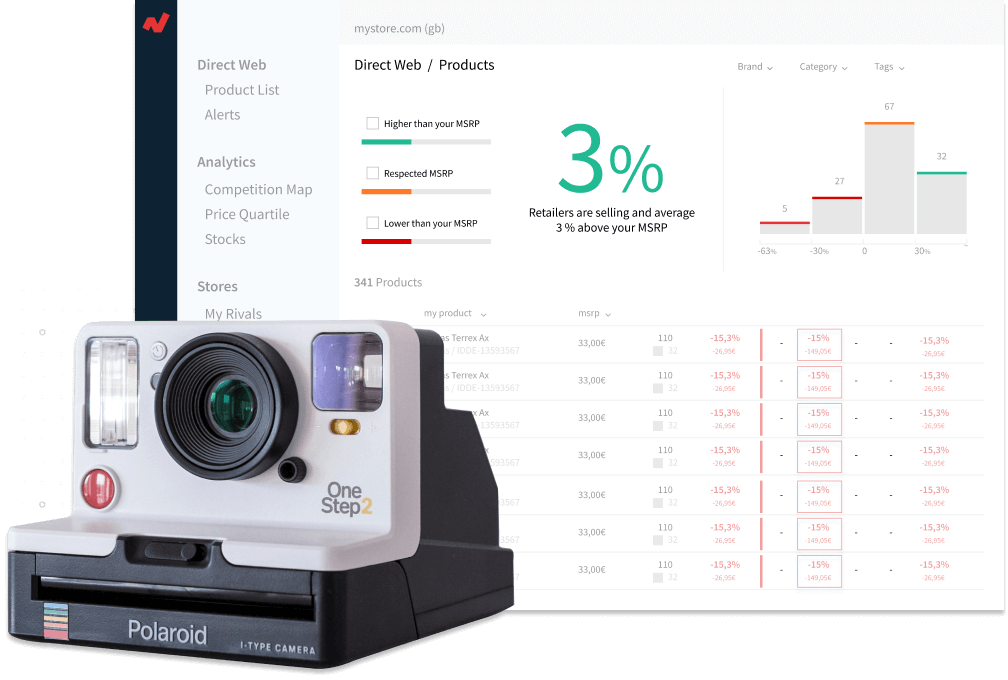

Business Intelligence to Analyze Thousands of Data

The study on price and stock evolution in food and beverages has been developed with the Business Intelligence technology of Netrivals, a company that was created in Barcelona in 2015 by entrepreneurs Iván Ramírez and Salvador Fàbregas. Their objective? To help both manufacturers and online stores to obtain a more complete vision of the state of the products on the market.

“On one hand, we offer ecommerce companies the positioning of their competitors’ products so that they can create an appropriate strategy. On the other hand, we carry out market studies so that manufacturers know how their own products are evolving,” explains Ramírez.

Netrivals analyzes in real time more than 500 million products in 40 thousand online stores worldwide. In addition, it stores 30 million opinions about products. It currently has more than 200 customers in 16 countries and expects to close 2020 with a turnover of three million euros.